Find the best business insurance - Easy, Today.

Fill in just one form and get quotations from several insurance brokers according to the criteria that suit you – for free.

The search for the perfect partner ends here

Let us take over. We’ll find the best fit for you, with zero cost and zero obligations.

Let’s solve this together

Tell us what you need, review the best matches, and let us do the work. You’ll receive up to 5 personalized offers crafted for you.

Ready to find the right fit?

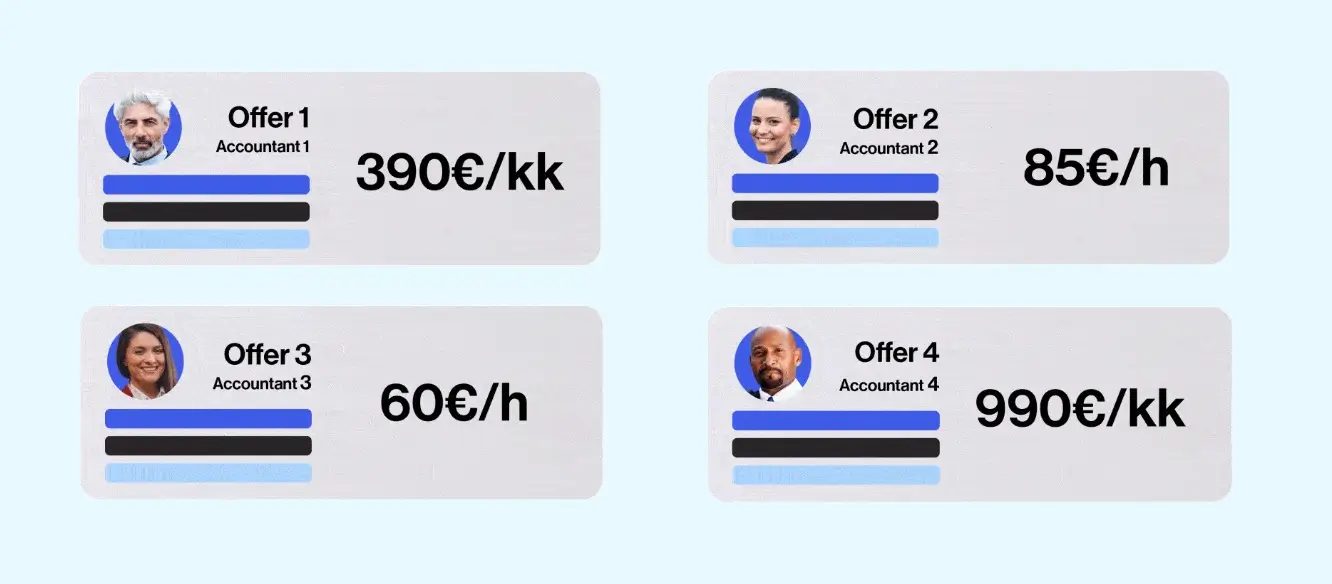

We’ve got options for ou. Expect at least 4 tailored offers to choose from. Compare them and select the one that aligns with your budget and needs.

Your free path to the best offers

OfferSwap delivers custom proposals from different providers, all aimed at solving your specific challenges. They all have one goal: to meet your needs.

- 100% free, zero obligations

- Personalized process

- 3-5 offers tailored to your needs

- No login requirement

- Get global and local offers

How to find the best business insurance in 2024?

To find the best business insurance in 2024, you should follow these steps:

Assess your business needs: review your business operations, risks and assets. Take into account the size, sector, location, number of employees and specific risk factors, such as the use of critical equipment or international operations.

Understand the importance of different types of insurance: find out about the protection offered by different types of insurance. This includes property insurance, liability insurance, workers’ compensation insurance, interruption insurance, product liability insurance, professional liability insurance, motor insurance, cyber insurance and other special insurance.

Compare insurance offers: look for several insurance offers from different insurance companies. Compare coverage, premiums, deductibles and price.

Use brokers and advisers: insurance brokers and advisers can help you understand complex insurance conditions and find the best solution for your business.

Check the reputation and reliability of insurance companies: check their customer ratings, financial stability and quality of service.

Consider future needs: make sure your insurance is flexible and allows for changes as your business grows or changes.

Take advantage of technology and digital solutions: use digital tools and platforms to compare and manage your policies.

Update and review your insurance regularly: as your business needs change, it is important to update your insurance cover to reflect these changes.

Follow legislation and industry trends: make sure your insurance is up to date with the latest laws and market trends.

Remember that the best insurance is not always the cheapest option, but the one that provides comprehensive cover for your business’s specific needs.

Need support with your Offer?

We’re here to assist. Start a conversation in the chat or check how Offerswap works by yourself.

What types of business insurance are there?

Liability insurance:

Provide protection if a company faces legal liability, for example in the event of a claim for damages or litigation. These include general liability insurance and professional indemnity insurance.

Property insurance

Protect a company’s physical assets, such as real estate, equipment and warehouses, against damage such as fire, theft or natural disasters.

Accident insurance for workers:

Mandatory in most countries, this insurance covers accidents and occupational diseases suffered by workers at work.

Interruption insurance:

Provide financial protection in the event of business interruption due to fire, natural disasters or other unexpected events.

Product liability insurance:

Important for manufacturers, distributors and retailers, this insurance covers damage caused by a company’s product or its use.

Professional indemnity insurance (i.e. errors and omissions insurance):

This insurance is important for service providers such as consultants, accountants and lawyers. It covers damage caused by professional errors or omissions.

Motor insurance:

Provides protection for company vehicles and covers damage caused by road accidents.

Cyber insurance:

Increasingly important in a digital world, cyber insurance protects against data breaches and other digital risks.

Group health and life insurance:

Companies can offer these policies to their employees as benefits, covering healthcare costs and providing financial security for the employee’s family in the event of death.

Travel insurance:

Important for companies whose employees travel frequently. It covers travel-related risks such as cancellation, medical treatment abroad and loss of luggage.

Questions?

If you can’t find the answer to your question on this page, remember that you can always contact us at: asiakaspalveluyritykselle.io and we will help you with your competition.

Why is business insurance important?

Business insurance is important because it protects a business against financial losses, for example from property damage, litigation or business interruption. It is a key part of risk management.

How much does business insurance cost?

The cost of insurance depends on many factors, such as the size of the business, the industry, the location, the amount of insurance chosen and the deductible. Prices vary significantly from company to company. Always remember to compete!

How do I choose the right insurance for my business?

To choose the right insurance, assess your business risks, compare the offers of different insurance companies and consider using the services of an insurance broker. It is important to choose insurance that covers the unique risks of your business in a cost-effective way.

Is business insurance compulsory?

Some business insurance, such as workers’ compensation insurance, is required by law in certain countries. Other insurances may be optional, but they are recommended to protect your business.