Compare accountants quickly and easily today and find the best option!

Comparing through Offerswap is 100% free

Just fill out a simple form and you are good to go.

Pick the best one.

Choose whether you want to go forward or not.

- It only takes a minute

The search for the perfect partner ends here

Let us take over. We’ll find the best fit for you, with zero cost and zero obligations.

Let’s solve this together

Tell us what you need, review the best matches, and let us do the work. You’ll receive up to 5 personalized offers crafted for you.

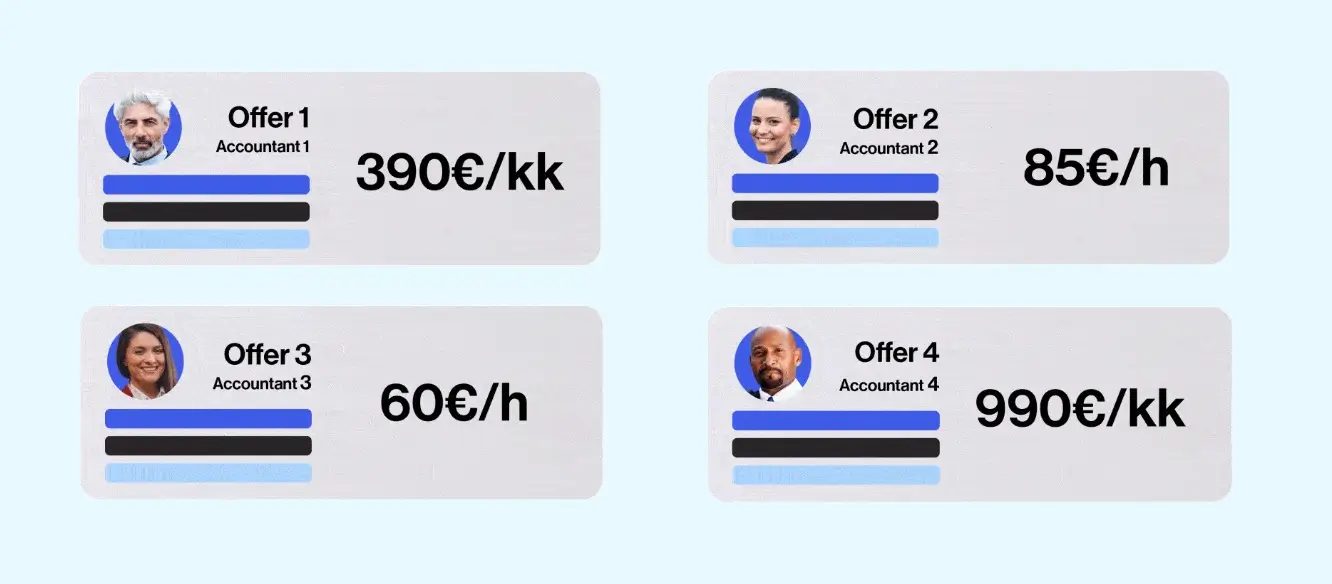

Ready to find the right fit?

We’ve got options for ou. Expect at least 4 tailored offers to choose from. Compare them and select the one that aligns with your budget and needs.

Reviews

See what business decision makers think about our service. Finding a provider is now a whole lot easier.

Your free path to the best offers

OfferSwap delivers custom proposals from different providers, all aimed at solving your specific challenges. They all have one goal: to meet your needs.

- 100% free, zero obligations

- Personalized process

- 3-5 offers tailored to your needs

- No login requirement

- Get global and local offers

Need support with your Offer?

We’re here to assist. Start a conversation in the chat or check how Offerswap works by yourself.

Questions?

If you can’t find the answer to your question on this page, remember that you can always contact us at: asiakaspalveluyritykselle.io and we will help you with your competition.

What is the difference between single-entry and double-entry accounting?

In simple accounting, transactions are recorded in only one accounting account, which is suitable for smaller businesses. Double-entry bookkeeping means that each transaction is recorded in both a debit and credit account, which allows for more accurate financial monitoring and is essential for larger companies.

What are the profit and loss account and the balance sheet?

The income statement and balance sheet are the two key elements of a company’s financial reporting and give a detailed picture of the company’s financial situation:

Income statement

The income statement, also called the profit and loss account, is a report that describes the financial performance of a company over a period of time, usually a year or a quarter. The profit and loss account shows the income and expenditure of the company and the resulting net profit or loss. It starts with turnover, i.e. sales, minus operating costs such as raw materials, salaries and other operational expenses. The difference is the operating profit or loss, from which taxes and any other expenses are deducted to give the final net result.

Rate

The balance sheet is a report that shows the financial position of a company at a given point in time. It is divided into two parts: assets and liabilities and equity. Assets reflect the resources owned by a company, such as cash, real estate and stocks. Debt and equity, on the other hand, show how these assets are financed, i.e. how much debt the company has and how much capital the owners have invested. In the balance sheet, total assets must always equal total liabilities and total equity.

What is Value Added Tax (VAT) and how does it affect accounting?

Value Added Tax (VAT) is a consumption tax that is added to the price of most goods and services. Businesses collect VAT from their customers and pay it to the state. In accounting, VAT is recorded separately for sales and purchases, and its accurate monitoring is important to ensure the accuracy of VAT declarations.

How do the accounts of different types of companies differ?

The main differences between the different types of companies are in their structure, reporting requirements and liability issues. Here is an overview of how accounting differs for some types of general partnership:

Business name (sole trader)

Accounting for a sole proprietorship is generally simpler than for larger companies. In many countries, sole traders can use simple accounting, which does not require double-entry bookkeeping. Their accounts focus mainly on income, expenditure and any business assets kept separately from the household.

Limited company (Oy)

Public limited companies have more complex accounting and stricter reporting requirements. Such companies usually use the double-entry method of accounting, which provides a more accurate view of the company’s financial situation. Public limited companies must also prepare annual financial statements, which include a profit and loss account, a balance sheet and possibly a cash flow statement.

Limited partnership (Ky) and General partnership (Ay)

In these types of companies, accounting can be more complex, especially when it comes to the owners’ investments and their returns. Double-entry bookkeeping is also common practice here. The personal financial information of the partners or general partner may be part of the company’s accounts if they are personally liable for the company’s obligations.

Public limited companies and Public limited companies (plc)

The accounting of public limited companies (plcs) must be very transparent and is often more complex due to their larger size and the fact that they are listed on a stock exchange. They must comply with strict regulatory requirements and standards, such as IFRS (International Financial Reporting Standards). Their financial statements need to be more detailed and often include additional information, such as the Board of Directors’ annual report and segment reports.

Associations and Foundations

Accounting for associations and foundations often focuses on donations, grants and other non-commercial income. Although their basic accounting principles are similar to those of companies, they often have specific reporting requirements regarding fundraising and the use of funds.